As Saudi Arabia’s startup and venture ecosystem matures, founders and investors are increasingly exploring flexible financing tools that bridge the gap between early-stage funding and priced equity rounds.

Convertible instruments such as Convertible Notes, SAFEs and KISS structures are becoming more common in discussions, yet their use in the Kingdom requires careful navigation of company law, regulatory approvals and Shariah principles. This article outlines how convertible financing operates in the Saudi context, the key distinctions between instruments, and the practical considerations that companies and investors must address to ensure enforceability and compliance.

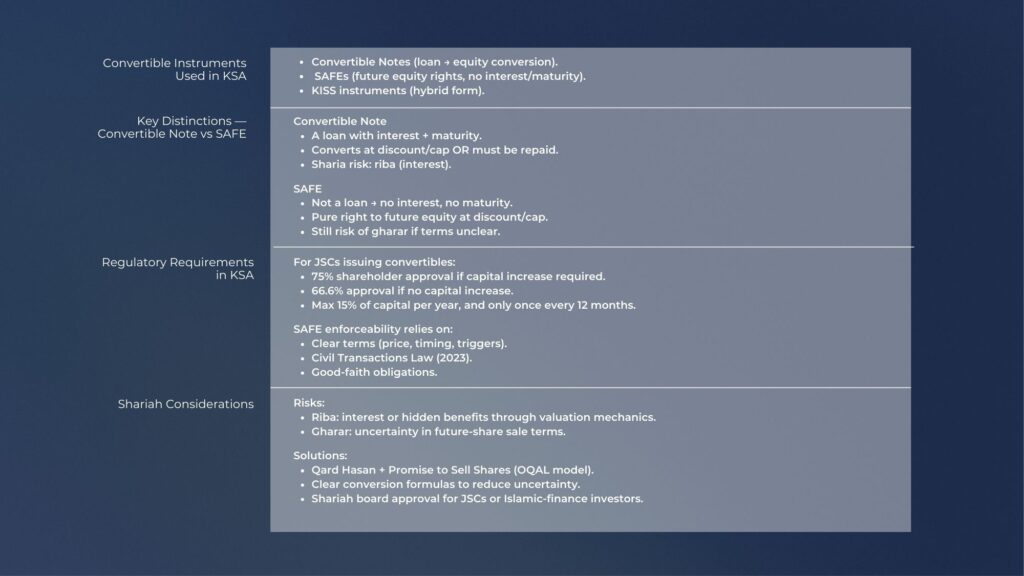

Understanding Convertible Instruments in KSA

Convertible financing refers to funding structures where an investor provides capital today with the expectation that it will convert into equity at a later stage, typically upon a qualifying financing round.

The most commonly discussed instruments in Saudi Arabia include:

- Convertible notes, which are structured as loans that may convert into equity at a later date.

- SAFEs (Simple Agreements for Future Equity), which provide a contractual right to receive equity in the future without being classified as debt.

- KISS instruments, which sit somewhere between notes and SAFEs, are less commonly used in the Saudi market.

While these instruments are familiar to international venture capital investors, their application in Saudi Arabia is not a direct “plug-and-play” exercise and must be adapted to local legal and Shariah frameworks.

Convertible Notes vs SAFEs: Key Legal Differences

A Convertible Note is, at its core, a loan. It typically carries interest and has a maturity date, at which point the note either converts into equity (often at a discount or valuation cap) or must be repaid. In Saudi Arabia, this structure raises immediate Shariah concerns, as interest-bearing loans may be viewed as riba. In addition, maturity and repayment obligations can introduce balance sheet and insolvency considerations for early-stage companies.

A SAFE, by contrast, is not a loan. It accrues no interest and has no maturity date. Instead, it gives the investor a contractual right to acquire equity in the future upon the occurrence of defined events, such as a priced equity round. While SAFEs avoid many RIBA-related issues, they can still face gharar risks if the terms around conversion, valuation or timing are insufficiently clear.

Regulatory Requirements for Saudi Companies

From a corporate law perspective, the use of convertible instruments depends heavily on the company’s legal form, particularly for Joint Stock Companies (JSCs). Where a convertible instrument ultimately requires a capital increase, Saudi regulations typically require shareholder approval of at least 75%. If no capital increase is triggered at issuance, a lower 66.6% threshold may apply. In addition, capital increases are generally capped at 15% of share capital per year and may be undertaken only once every 12 months.

For SAFEs, enforceability does not stem from specific “SAFE legislation” but rather from general contract principles under Saudi law, including the Civil Transactions Law (2023). Clear drafting defined triggers and demonstrable good faith are therefore critical to reducing legal uncertainty.

Shariah Considerations: Risks and Mitigations

The two principal Shariah risks associated with convertible financing are riba and gharar.

- Riba concerns may arise when interest is charged or when valuation mechanics result in hidden or disproportionate economic benefits to the investor.

- Gharar may arise if the future sale of shares is subject to excessive uncertainty, such as undefined conversion prices or open-ended timelines.

To address these risks, market participants in Saudi Arabia often adopt alternative or modified structures. These may include interest-free funding arrangements (Qard Hasan) combined with a separate promise to sell shares in the future, or carefully drafted SAFEs with transparent conversion formulas, valuation caps and discounts. For companies with Shariah-sensitive investor bases, obtaining Shariah board approval is often advisable.

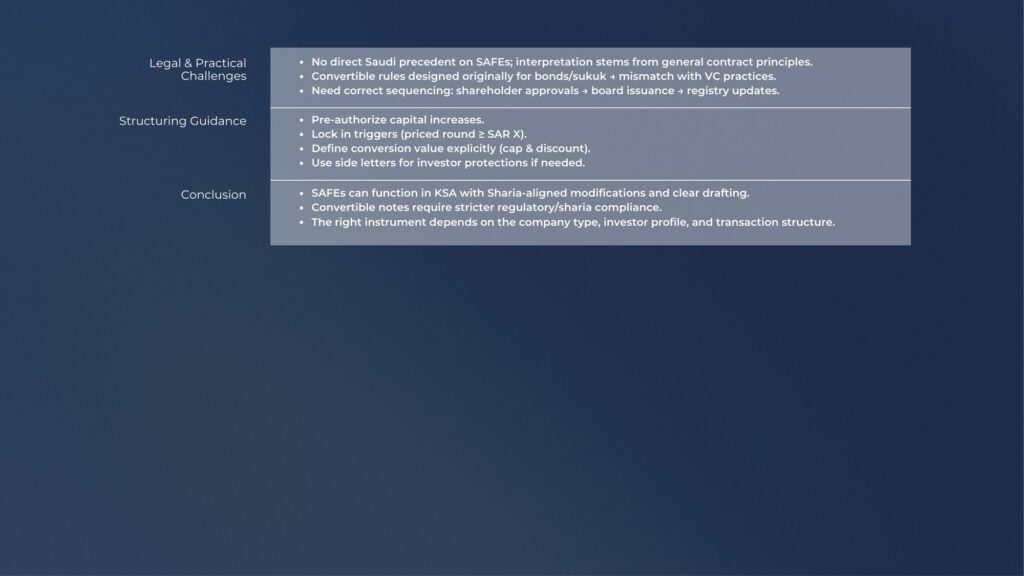

Practical and Legal Challenges

Despite growing market familiarity, there is still no direct Saudi judicial precedent dealing specifically with SAFEs. Their enforceability relies on broader contractual interpretation rather than instrument-specific guidance. In addition, Saudi convertible rules were historically designed with bonds and sukuk in mind, which can create friction when applied to venture-style financing.

Process discipline is therefore essential. Companies must ensure the correct sequencing of approvals, from shareholder resolutions to board issuances and commercial registry updates. Failure to do so can undermine the instrument’s validity or delay conversion at a critical growth stage.

Structuring Convertible Financing Effectively

Well-structured convertible financings in Saudi Arabia typically share several features. These include pre-authorised capital increases, clearly defined conversion triggers (such as a priced round above a stated valuation), and explicit conversion mechanics setting out caps and discounts. Where additional investor protections are required, these are often addressed through side letters rather than over-complicating the core instrument.

Convertible financing can play a valuable role in supporting early-stage and growth companies in Saudi Arabia, but it must be approached with care. SAFEs can be made to function effectively when drafted with clarity and adapted to Shariah considerations, while convertible notes demand stricter scrutiny from both a regulatory and religious perspective. Ultimately, the choice of instrument depends on the company’s legal form, the investor profile, and the broader transaction structure. With thoughtful structuring and robust documentation, convertible financing can align international venture practices with Saudi legal and cultural requirements.

In Summary: