Learn how market trends and legislative changes are changing employee compensation in the UAE and KSA, encouraging startups to adopt equity-based rewards.

This article was co-created by HMCo team and Carta.

For MENA’s growing startup ecosystem, equity is shifting from a nice-to-have to a key part of competitive compensation. Founders increasingly see employee ownership as a way to attract top talent, improve retention, and align teams with long-term company growth.

Despite this momentum, many companies still find it challenging to craft a well-structured employee share ownership plan (ESOP) to incentivise employees. With so many moving parts to consider, from navigating implementation rules to designing the right vesting schedules, it can be difficult for founders if they don’t get it right the first time.

Carta works with thousands of global founders and understands the complexities involved in designing the right ESOP for their team. That’s why we partnered with HMCo to outline the legal, operational, and cultural considerations for ESOPs to help founders reshape their employees’ ownership journeys in the United Arab Emirates (UAE) and Kingdom of Saudi Arabia (KSA).

What is an ESOP?

An ESOP is a long-term incentive plan (LTIP) that grants employees the right to buy shares at a predetermined strike price at a time in the future, subject to vesting. Typically, new shares are issued when the options are exercised.

When designed well, an ESOP can be a powerful tool for startups to build a culture of ownership. By giving employees a chance to own a portion of the company, you’re turning them into owners. This aligns the interests of employees with those of the company, which is an effective method to attract, motivate, and retain top talent. When you link rewards to the company’s long-term performance, ESOPs can foster sustained commitment and contribution to overall company growth.

Types of vesting structures

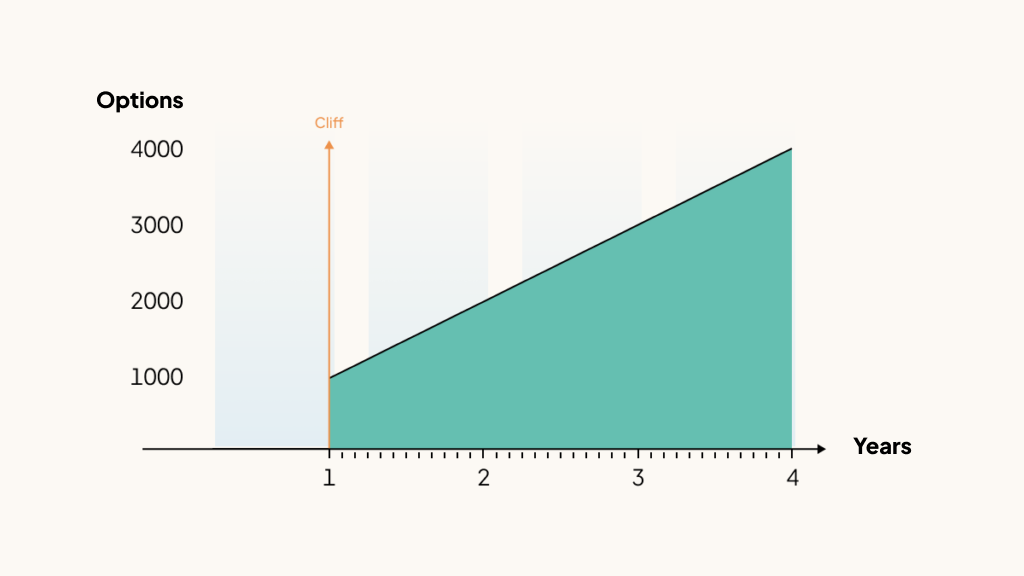

ESOPs typically include vesting structures which vary based on a company’s needs and may include:

- Cliff vesting: This is the most common model where all granted options become exercisable after a defined period of time.

- Graded vesting: This lets a portion of the options vest incrementally over time.

- Ratable vesting: This ensures a consistent percentage of the granted options vest at regular intervals.

Many companies start with a cliff period followed by a graded or ratable vesting schedule.

Best practices for designing ESOPs

When designing ESOPs, companies must also consider various liquidity and exit strategies to help navigate key moments.

Key best practices include:

- Implementing buyback clauses: This allows the company to repurchase shares if an employee leaves.

- Tying exercise to a liquidity event: This ensures that options are exercisable only upon an IPO or acquisition.

- Using alternative equity incentives: One example is to offer phantom shares, which provide cash rewards based on share price appreciation without actual equity transfer.

Companies should also consider the accounting impact of creating ESOPs, because these plans create an obligation to issue stock at a discount or pay employees in cash. Both items may require recording in the companies’ books as liabilities.

Key legal considerations for ESOPs in the UAE and KSA

United Arab Emirates

The UAE’s legal system has multiple jurisdictions, so where you’re incorporated matters when you want to issue ESOPs.

Key jurisdictions include:

- Onshore UAE (Mainland): Companies operating in onshore UAE are governed by the Federal Decree-Law No. 32 of 2021 on Commercial Companies. This law does not have specific rules for ESOPs, but companies can still implement such plans through internal corporate governance with the right approvals.

In onshore UAE, non-UAE nationals may face restrictions on holding shares in certain sectors. This is where options like phantom share schemes, where an entity holds the shares on behalf of the employee, can be used as alternatives.

- Free zones: Jurisdictions like the Dubai International Financial Centre (DIFC) and Abu Dhabi Global Market (ADGM) offer more structured legal frameworks for ESOPs, often incorporating elements of common law. These jurisdictions make it easier to use trusts, nominee structures, and special purpose vehicles (SPVs) to hold shares on behalf of employees, ensuring compliance with foreign ownership restrictions.

Free zone companies may also need to comply with employment and securities laws relevant to their jurisdiction.

Kingdom of Saudi Arabia

In KSA, the key to issuing ESOPs is getting approval from your shareholders.

- For a joint-stock company: This means getting approval of shareholders from at least three-quarters of the voting shares at an extraordinary general assembly meeting.

- For a limited liability company: This means getting approval of one or more partners holding at least three-quarters of the capital.

Board approval may also be required, depending on your company’s bylaws or articles of association.

The good news is that ESOPs are generally considered an exempted offer and do not trigger filing requirements. This designation allows employers to issue unlisted, contract-based securities to employees without being subject to the full scope of applicable Capital Market Authority (CMA) regulations.

That said, the CMA does impose specific disclosures. These include quarterly notifications to the CMA detailing the total number and value of the exempted offers and reporting on any ongoing ESOP offers.

The MENA region embraces ESOPs

Carta data shows that 67% of grants in Middle East (ME) startups follow a four-year vesting schedule with a one-year cliff, signaling that startups in the region are consistent in their equity vesting practices. The regional norm for structure is 25% of equity vests after the first year and the remaining 75% vests monthly thereafter.

This growing culture of ownership in the MENA region shows a fundamental shift in how companies approach talent and growth. If founders understand the process of designing a well-structured ESOP, they can not only attract and retain top talent, but also build a culture of shared success.

In MENA, where equity has become a must-have, sharing ownership is the new engine for growth.

DISCLOSURE: This communication is on behalf of eShares, Inc. dba Carta, Inc. (“Carta”) and HMCo. This communication is for informational purposes only, and contains general information only. Carta and HMCo are not, by means of this communication, rendering accounting, business, financial, investment, legal, tax, or other professional advice or services. This publication is not a substitute for such professional advice or services nor should it be used as a basis for any decision or action that may affect your business or interests. Before making any decision or taking any action that may affect your business or interests, you should consult a qualified professional advisor. This communication is not intended as a recommendation, offer or solicitation for the purchase or sale of any security. Carta and HMCo do not assume any liability for reliance on the information provided herein.

© 2025 Carta. All rights reserved. Reproduction prohibited. Regulated by the Financial Services Regulatory Authority.

The contents of this article may contain attorney advertising under the laws of various jurisdictions. Prior results do not guarantee a similar outcome. By receiving this communication you understand and agree that no information is being provided in the context of any attorney-client relationship and that nothing herein is intended to constitute legal advice. This communication is solely informational in nature, not intended as a substitute for competent legal advice from a licensed and retained attorney in your jurisdiction, and should not be so used.